|

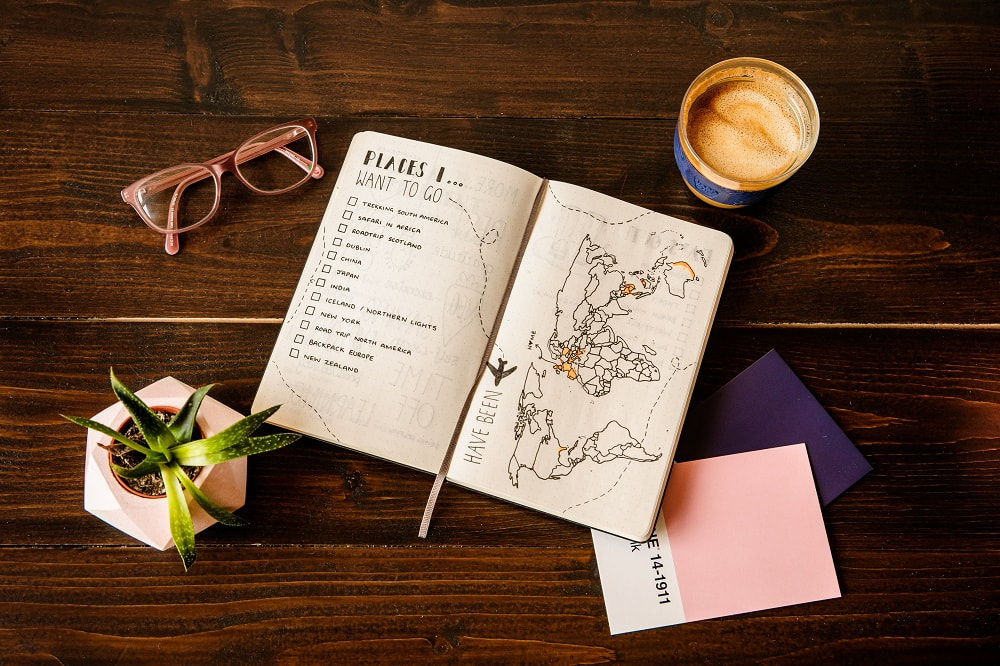

National Plan for Vacation Day is on January 25th so here are some savings tips we put together for you to begin planning your next holiday. For ideas on where to go, simply check out new and old editions of Traveler and Tourist! You are bound to find a destination or venue you'd like to visit with friends, family or on a solo adventure. Read on to see how you can make those vacation dreams a reality this year...

Let's start with budgeting.

Hold yourself accountable with a clear budget. Where do you want to go and what do you want to do there? What will that cost and which items do you want to save on while splurging on others? These are important to review at the start of the planning phase. I like to visit one or two high-end restaurants when I travel so I ensure my dining choices on other days are more economical. If there are multiple day trips I want to experience then I chart out a budget for each to see which would be affordable and which ones I'd need to plan and save for a little bit longer. Now comes the planning List all the attractions and activities you want to experience and calculate what that will cost you. That's not to say these are the only experiences you will have but it helps to see a figure of what this will cost overall. Then you can decide which of those items make the cut or not. Are there group discounts, low season or free entry days you can avail to help save on your overall budget? I also check credit card deals or other loyalty programs I am a member of that might have good offers I can use toward my vacation and the activities I want.

Put aside your savings

Use an app or create an account with your bank where you can set aside money for your vacation. This can be a certain amount every week or month or a larger amount every quarter that goes solely toward your travel expenses and the activities you will enjoy while on vacation. This way you won't have to put all your expenses on your credit card or dig into another savings account. I like that you can see at one glance what your savings are so far and how much you need to reach your goals to afford the experiences you want. Divide your savings Within the amount you put aside as savings, set aside some money for your splurges. This can be anything from a fancy hotel stay for part of your vacation to a shopping spree for home decor. But you have the satisfaction of knowing you have money specifically for that purpose vs. feeling like you were on a strict budget the whole time. And then feeling guilty about spending too much on any one thing. I like to do this for special events, live performances or other unique experiences that I feel I might only be able to indulge in that destination.

Channel certain funds

If you can assign money earned from a certain client or project toward your vacation savings, then that gives you a clear idea of funds you have channeled specifically to this purpose. They cannot be used for any other spending and neither will you be dipping into other accounts to funnel any money from there to your vacation savings. I believe that clarity might help with budgeting for the long term so you are not scrambling last minute to put together the savings you need to enjoy your vacation stress-free. Have more tips or plans on where you will vacation this year? Let us know in the comments below!

0 Comments

Leave a Reply. |

FavesSharing a few products that I love. Some are affiliate links, some are not, some I was introduced to and some I happened to chance upon. Enjoy! Archives

January 2022

Categories

All

|

RSS Feed

RSS Feed